Instruction 3-1

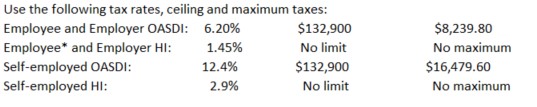

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

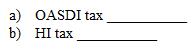

Refer to Instruction 3-1 . On the last weekly pay of the first quarter, Lorenz is paid her current pay of $90 per day for four days worked and one day sick pay (total-$450). She is also paid her first quarter commission of $1,200 in this pay. How much will be deducted for:

Definitions:

Job Enlargement

The process of increasing the range and variety of tasks that an employee performs, aimed at enhancing job satisfaction and productivity.

Cross-Functional HR

An approach to human resource management where HR functions intersect with other departments to enhance organizational performance and strategy.

Collaborative Approach

A method or strategy that emphasizes working together with others in a cooperative manner to achieve shared or common goals.

HR Training

HR Training involves programs and activities designed to develop skills, knowledge, and competencies necessary for employees to perform effectively in their roles, facilitated by the human resources department.

Q4: Under the Federal Insurance Contributions Act, the

Q4: Employee's payroll deductions into their 401(K) plans

Q19: Which of the following is part of

Q49: Employees who regularly work less than 20

Q82: Which of the following practices will help

Q85: The last step in the financial planning

Q91: In converting semimonthly wage rates to hourly

Q95: Under the continental system of recording time,

Q96: Under the Affordable Care Act, all employers

Q99: The Affordable Care Act does not make