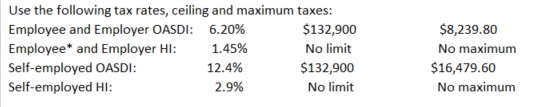

Instruction 3-1

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

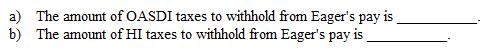

Refer to Instruction 3-1 . Eager, a tipped employee, reported to his employer that he had received $320 in tips during March. On the next payday, April 6, he was paid his regular salary of $400.

Definitions:

Intervertebral Disk

A fibrocartilaginous disc situated between adjacent vertebrae in the vertebral column, acting as a shock absorber and allowing movement.

Thoracic Region

The part of the body including the chest, between the neck and the abdomen, containing the thoracic vertebrae and ribs.

Vertebra

One of the individual bones that make up the vertebral column (spine), providing structural support and protection for the spinal cord.

Body Of Vertebra

The thick, oval segment of a vertebra forming the front of the vertebrae, supporting the majority of the body's weight.

Q2: The FUTA tax paid to the federal

Q3: In calculating a "gross-up" amount of a

Q15: In some states, employers may obtain reduced

Q25: Employers who fail to file employment tax

Q47: What tax act levies a tax on

Q56: An exception to the protection that the

Q56: Form 941 is used by employers to

Q59: To curb the practice of employees filing

Q61: For the purpose of the FUTA tax,

Q81: A strong economy leads to:<br>A) a low