Instruction 3-1

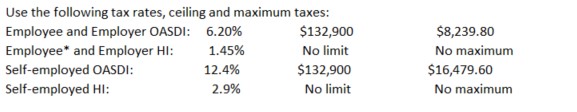

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

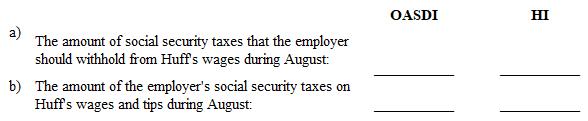

Refer to Instruction 3-1 . On August 1, Huff (part-time waitress) reported on Form 4070 the cash tips of $158.50 that she received in July. During August, Huff was paid wages of $550 by her employer. Determine:

Definitions:

Direct Labor Budget

A financial plan that estimates the cost of the direct labor required to meet production needs, including wages of workers who are directly involved in the manufacturing of goods.

Cash Budget

A forecast of cash inflows and outflows over a specific period, used to manage liquidity and ensure sufficient cash is available for operations.

Operating Budgets

Detailed projections of income and expenses related to a company's operational activities for a specific period, typically one year.

Budgeted Balance Sheet

A budgeted balance sheet forecasts a company's financial position at a future date, including assets, liabilities, and shareholders' equity, based on projected financial activities.

Q10: In preparing legal research for a contracts

Q10: If an employee who left the company

Q11: Employers file Form 941 with the IRS

Q28: Exempt educational assistance includes payments for tools

Q37: Form W-3 is filed with the Social

Q61: At the time that the entry is

Q64: Unmarried persons are distinguished from married persons

Q71: If a business has ceased operations during

Q93: The payroll register is a separate payroll

Q111: A detailed financial report used to monitor