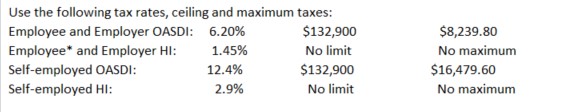

Instruction 3-1  *Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Refer to Instruction 3-1 . Jax Company's (a monthly depositor) tax liability (amount withheld from employees' wages for federal income tax and FICA tax plus the company's portion of the FICA tax) for July was $1,210.

No deposit was made by the company until August 24, 20-- (9 days late). Determine:

a) The date by which the deposit should have been made

b) The penalty for failure to make timely deposit

c) The penalty for failure to fully pay tax when due

d) The interest on taxes due and unpaid (assume a 5% interest rate)

Definitions:

Marginal Product

The additional output resulting from the use of an additional unit of a variable input, holding all other inputs constant.

Wage Rate

The amount of money paid to an employee per unit of time, often per hour or per year, for labor services.

Marginal Product of Labor

The additional output produced as a result of adding one more unit of labor, all else being constant.

Optimal Level of Resource Use

The most efficient, sustainable use of resources that maximizes benefits while minimizing negative environmental and economic impacts.

Q6: Form I-9, which is completed by each

Q7: Whether a transaction is common law or

Q7: Form 941 is due on or before

Q13: The number of withholding allowances claimed by

Q15: In some states, employers may obtain reduced

Q45: An income and expense statement provides a

Q49: A federal unemployment tax is levied on:<br>A)

Q66: The payments to a cook employed by

Q75: One of the tests to be met

Q87: Ben invests $10,000 at a rate of