Instruction 3-1

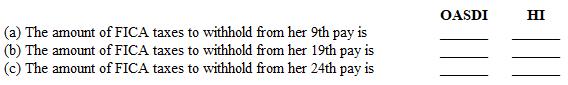

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $132,900; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable.

Refer to Instruction 3-1. During 20--, Amanda Hines, president of Dunne, Inc., was paid a semimonthly salary of $7,100. Determine the following amounts.

Definitions:

Unemployment Rate

The rate of individuals in the workforce who are not employed but are seeking a job.

Random Sample

A sample in which each member of a population has an equal chance of being selected, ensuring the representativeness of the sample.

Statistics Canada

The national statistical office of Canada, which provides essential information on Canada's economy, society, and environment.

Alpha

A parameter in statistical hypothesis testing representing the probability of rejecting the null hypothesis when it is actually true (Type I error).

Q6: Instruction 3-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9171/.jpg" alt="Instruction 3-1

Q9: Construct a balance sheet using the following

Q16: Accumulating wealth for later years is called

Q30: Under the Federal Personal Responsibility and Work

Q33: All of the following persons are classified

Q38: Schedule A of Form 940 only has

Q45: When employees spend time changing clothes on

Q62: In recording the monthly adjusting entry for

Q80: The best way to handle inflation in

Q89: Retirement planning includes taking advantage of and