Instruction 3-1

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $132,900; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable.

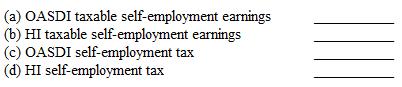

Refer to Instruction 3-1. Karlie Hastings is a writer (employee) for the Santa Fe Gazette and has an annual salary of $49,000. This year, she also realized net self-employment earnings of $85,000 from a book she wrote. What portion of her self-employment earnings is subject to the two parts of the social security tax?

Definitions:

Compounded Semiannually

Refers to the process of calculating interest on both the initial principal and the accumulated interest over two periods within a year.

Withdraw Every Six Months

A financial term that refers to the process of taking money out of an account or investment at semiannual intervals.

Investment Account

An account that holds financial assets such as stocks, bonds, mutual funds, or other investments managed by a financial institution or individual.

Present Values

Present Values represent the current value of a future sum of money or stream of cash flows given a specified rate of return.

Q9: Money is an important motivator of personal

Q11: Formation is one of the issues that

Q20: Warranty exclusions should be <br>A)stated.<br>B)excluded.<br>C)implied.<br>D)hidden.

Q20: What can you do if your budget

Q41: A nondiscretionary bonus is one that is

Q57: Which of the following is not part

Q60: Employer contributions for retirement plan payments for

Q71: Under FICA, employers must collect the employee's

Q78: The three parts of an individual's balance

Q104: Which of the following laws establishes the