Instruction 3-1

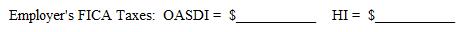

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $132,900; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable.

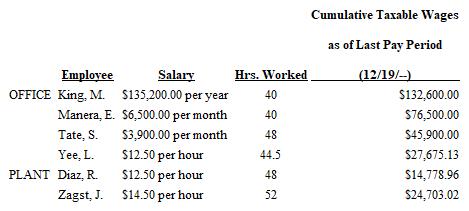

Refer to Instruction 3-1. At Haddon, Inc., the office workers are employed for a 40-hour workweek and are paid on either an annual, monthly, or hourly basis. All office workers are entitled to overtime pay for all hours worked beyond 40 each workweek at 1.5 times the regular hourly rates.

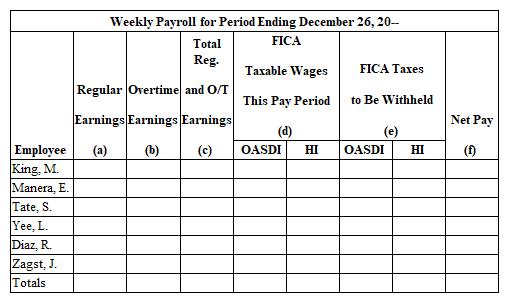

Company records show the following information for the week ended December 26, 20--.  On the form below, calculate for each worker: (a) regular earnings, (b) overtime earnings, (c) total regular and overtime earnings, (d) FICA taxable wages, (e) FICA taxes to be withheld, and (f) net pay for the week ended December 26, 20--. Assume that there are 52 weekly payrolls in 20--. Also, determine the total for each of these six items.

On the form below, calculate for each worker: (a) regular earnings, (b) overtime earnings, (c) total regular and overtime earnings, (d) FICA taxable wages, (e) FICA taxes to be withheld, and (f) net pay for the week ended December 26, 20--. Assume that there are 52 weekly payrolls in 20--. Also, determine the total for each of these six items.

Definitions:

Personal Goals

Individual objectives that a person aims to achieve, which can be short-term or long-term and vary in nature.

Achievable Goals

Objectives that can realistically be accomplished within a given timeframe and with available resources.

McGregor

Douglas McGregor, an American social psychologist who proposed the Theory X and Theory Y concepts of employee motivation and management.

Theory Y

A management concept based on the belief that employees are intrinsically motivated to work and can be trusted with responsibility and autonomy.

Q3: The federal unemployment tax is imposed on

Q12: Those records that are required by the

Q17: Impracticability is an excuse for which of

Q38: All interns in the for-profit sector are

Q42: Exhibit 4-1 : Use the following tables

Q45: Under the federal income tax withholding law,

Q52: In its definition of employee , FICA

Q53: Workers' compensation insurance premiums for employers vary

Q64: The location of the employee's residence is

Q105: The liquidity ratio is designed to show