Instruction 3-1

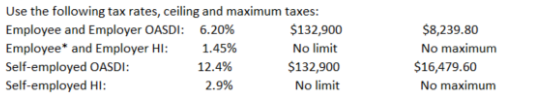

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

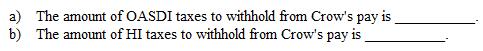

Refer to Instruction 3-1 . Crow earned $585.15 during the week ended March 1, 20--. Prior to payday, Crow had cumulative gross earnings of $4,733.20.

Definitions:

Visually Impaired

A term describing individuals who have reduced or absent vision, either congenitally or through acquired conditions.

Stimuli

External factors or agents that can elicit a physiological or psychological response or reaction in an organism.

Perception

The process of interpreting sensory information to form a meaningful understanding of the environment.

Reception

Reception generally refers to the act or process of receiving or being received, often used to describe the area in a building where visitors are greeted.

Q4: E-Sign is which of the following?<br>A)State law<br>B)Uniform

Q6: Career plans should not be changed after

Q12: The average propensity to consume is commonly

Q15: A buyer can revoke an acceptance if

Q20: Jurisdiction can be contractually determined by the

Q37: Federal tax levies are not subject to

Q43: Every state imposes state unemployment taxes on

Q70: In the adjusting entry to accrue wages

Q72: Exhibit 4-1 : Use the following tables

Q118: Financial planning is necessary only if an