Instruction 3-1

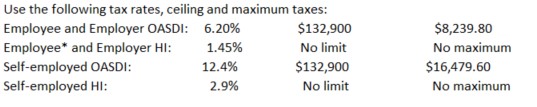

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Refer to Instruction 3-1 . On the last weekly pay of the first quarter, Lorenz is paid her current pay of $90 per day for four days worked and one day sick pay (total-$450). She is also paid her first quarter commission of $1,200 in this pay. How much will be deducted for:

Definitions:

Straight-Line Method

A depreciation technique that allocates an equal amount of depreciation expense over the useful life of an asset.

Semiannual Interest

Interest payments made twice a year on investments or loans.

Bond Payable

A long-term liability where a borrower agrees to pay back a specified sum of money plus interest to bondholders at future dates.

Short-Term Lease

A short-term lease is a rental agreement for a specified period of time, often less than a year, commonly used for temporary housing or seasonal business operations.

Q2: Form 944 (annual form) can be used

Q28: A waiter receives cash tips amounting to

Q51: Employers do not pay payroll taxes on

Q60: The employer keeps track of each employee's

Q62: In recording the monthly adjusting entry for

Q75: In the IRA form of the Simple

Q77: Asking applicants for their arrest records is

Q82: Wage differentials between sexes would be allowed

Q105: The liquidity ratio is designed to show

Q122: Financial plans provide direction to annual budgets.