Instruction 3-1

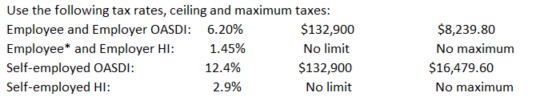

*Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed.

Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows:

1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimals places (round the hourly rate to 2 decimal places

before multiplying by one and one-half to determine the overtime rate).

2. If the third decimal place is 5 or more, round to the next higher cent.

3. If the third decimal place is less than 5, drop the third decimal place.

Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow.

Refer to Instruction 3-1 . In this pay, Moss Company deducted OASDI taxes of $5,276.24 and HI taxes of $1,233.95 from the $85,100.90 of taxable wages paid. What is Moss Company's portion of the social security taxes for:

a) OASDI

b) HI

Definitions:

Straight-Line Method

A method of calculating depreciation or amortization by evenly spreading the cost over an asset's useful life.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the decrease in the asset's value over time.

Useful Life

The estimated duration a fixed asset is expected to be economically utilisable by the business before it's fully depreciated.

Goodwill

An intangible asset representing the value of a company's brand, customer relationships, employee relations, and other non-physical assets.

Q9: If an employer is subject to a

Q13: Which of the following is not a

Q13: Caruso Company's SUTA rate for next year

Q18: The withholding of federal income and FICA

Q28: Jurisdiction can be contractually determined by the

Q36: Services performed by a child under the

Q37: Form W-3 is filed with the Social

Q40: The payroll register is used by employers

Q46: If an employee has more than one

Q114: Employee benefits may include all of the