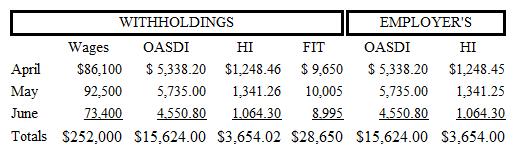

Lidge Company of Texas (TX) is classified as a monthly depositor and pays its employees monthly. The following payroll information is for the second quarter of 20--.

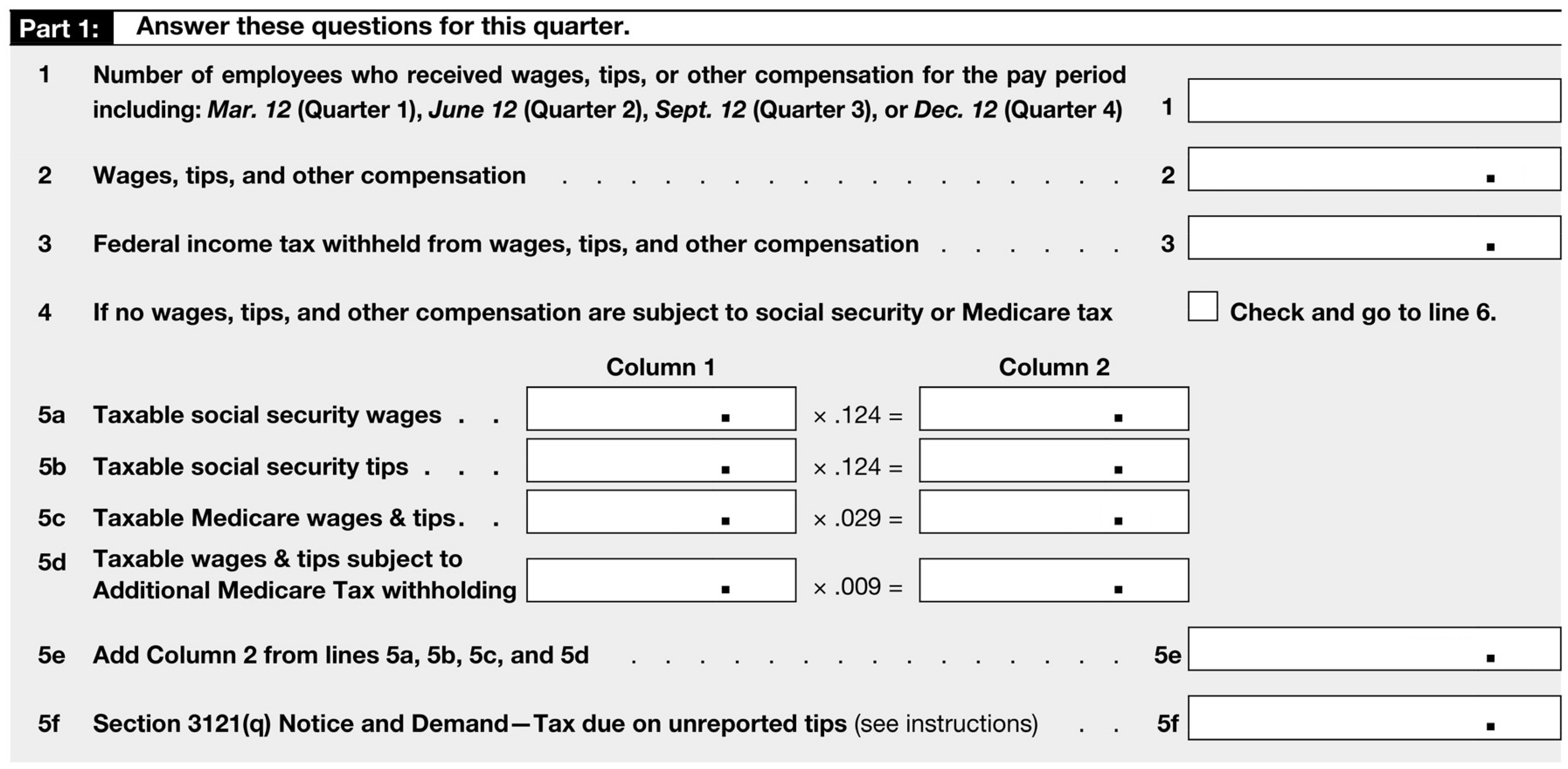

The number of employees on June 12, 20-- was 11.

a. Complete the following portion of Form 941.

Source: Internal Revenue Service

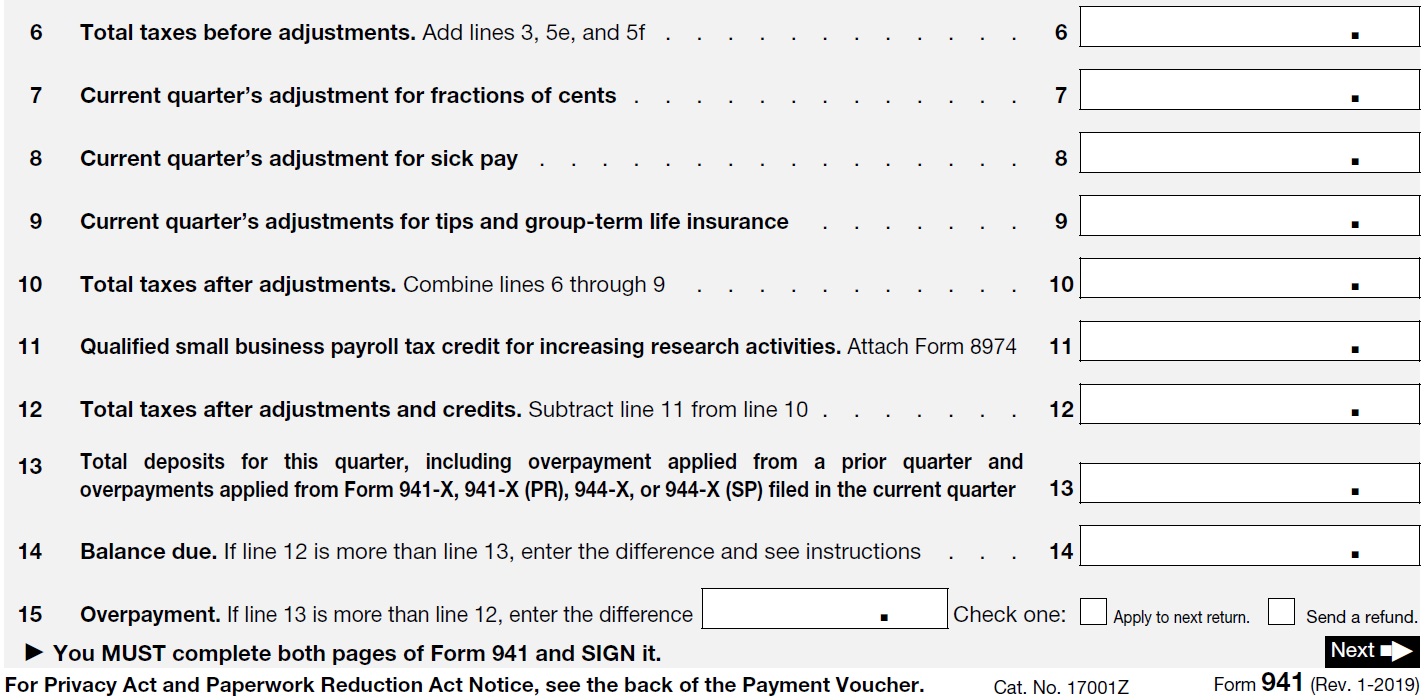

b. Complete the following portion of Form 941.

Source: Internal Revenue Service

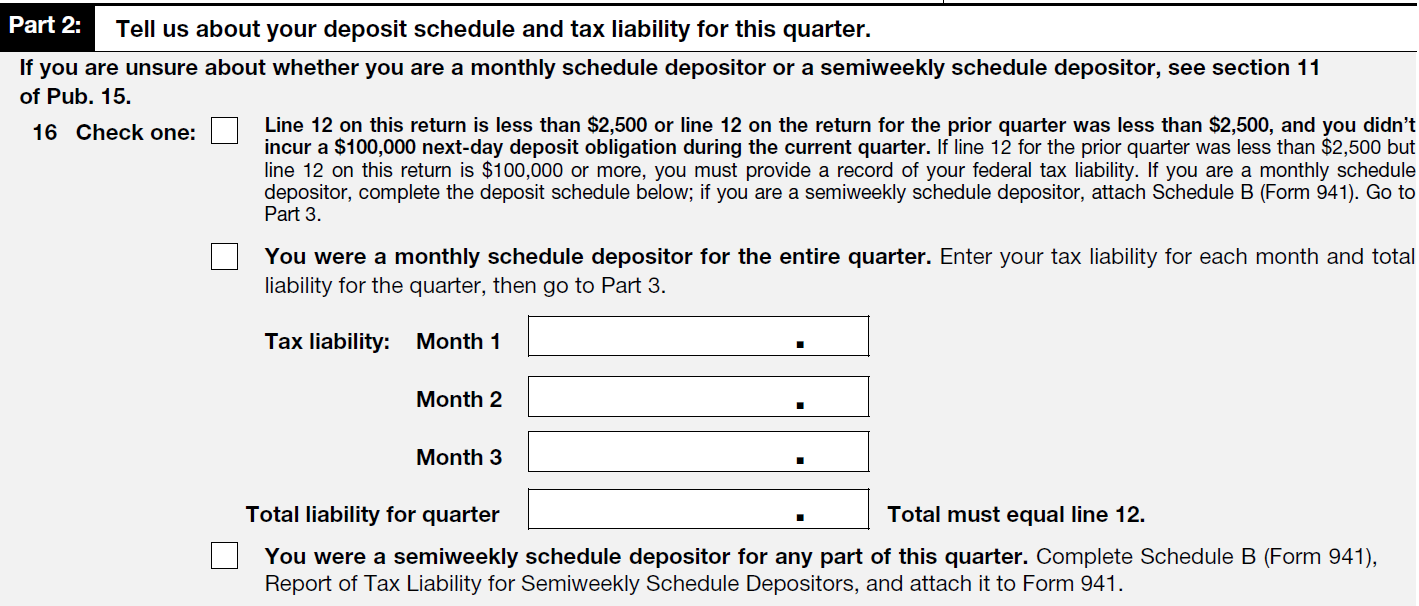

c. Complete Part 2 of Form 941.

Source: Internal Revenue Service

d. What are the payment due dates of each of the monthly liabilities assuming all

deposits were made on time, and the due date of the filing of Form 941 (year 20--)?

Definitions:

Case Study

An in-depth analysis of a particular subject, group, or event to explore causation in order to find underlying principles.

Analogue Experiment

A research method in which the researcher attempts to replicate or simulate under controlled conditions aspects of a real-life situation.

Matched Design Study

A research design in which participants are paired or grouped based on certain shared characteristics to help ensure that the conditions being compared are as similar as possible.

Informed Consent

A process in which a patient voluntarily agrees to participate in a treatment, research study, or procedure after understanding the risks, benefits, and alternatives.

Q2: Contracts on the Internet have received special

Q5: A contract that requires the user to

Q13: When editing, the paralegal should be looking

Q13: Caruso Company's SUTA rate for next year

Q22: FICA defines all of the following as

Q24: The adjusting entry to record the accrued

Q34: When recording the employer's payroll taxes, a

Q35: Questions pertaining to religion, gender, national origin,

Q47: _ plans are most helpful in making

Q106: Which of the following is an example