Instruction 3-1

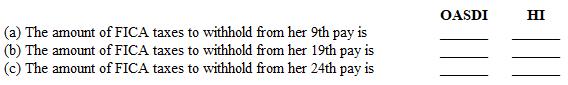

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $132,900; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable.

Refer to Instruction 3-1. During 20--, Amanda Hines, president of Dunne, Inc., was paid a semimonthly salary of $7,100. Determine the following amounts.

Definitions:

Wage Differential

Wage differential refers to the variation in wages between individuals, occupations, locations, or sectors due to factors like skill level, demand, or cost of living.

Nonpreferred-Race Workers

Employees who are perceived or categorized as belonging to a racial or ethnic group that is less favored or discriminated against within a societal or organizational context.

Statistical Discrimination

A decision-making process that uses statistical or probability information on groups rather than individuals, leading to potential biases.

Long Run

The Long Run is a time period in economics during which all factors of production and costs are variable, allowing for full industry adjustment.

Q1: Sam and his wife, Ann, purchased a

Q3: A discretionary bonus is included in an

Q7: Included under the definition of employees for

Q8: The garnishment that takes priority over all

Q10: Which of the following acts deals with

Q51: Under no conditions may children under age

Q53: Which of the following noncash fringe benefits

Q60: The employer keeps track of each employee's

Q86: Services performed in the employ of a

Q93: Mike's annual income is $45,000, and he