Instruction 3-1

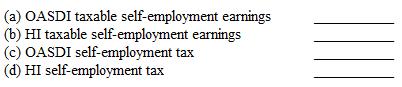

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $132,900; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable.

Refer to Instruction 3-1. Karlie Hastings is a writer (employee) for the Santa Fe Gazette and has an annual salary of $49,000. This year, she also realized net self-employment earnings of $85,000 from a book she wrote. What portion of her self-employment earnings is subject to the two parts of the social security tax?

Definitions:

Board Games

Tabletop games that involve counters or pieces moved or placed on a pre-marked surface or "board," according to a set of rules.

Hours of Sleep

The duration of time spent in a state of rest during which the body is not active and the mind is unconscious.

Thought Process

The mental operation involving reasoning, decision making, and problem solving, reflecting how an individual thinks or forms ideas.

Magical Thinking

A belief that one's thoughts, wishes, or desires can influence the physical world in ways that defy conventional laws of cause and effect.

Q5: Ambiguity occurs when a reader can interpret

Q6: Which of the following is a clause

Q19: A contract can be based on which

Q21: Contracts transactions cannot contain both common law

Q30: FICA defines wages as including the cash

Q34: When recording the employer's payroll taxes, a

Q43: Which of the following ratios indicates your

Q55: An employee's marital status and number of

Q103: The hiring notice is a record sent

Q110: If an employer is unable to obtain