Instruction 3-1

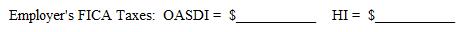

Use the following tax rates and taxable wage bases: Employees' and Employer's OASDI-6.2% both on $132,900; HI-1.45% for employees and employers on the total wages paid. Employees' Supplemental HI of 0.9 percent on wages in excess of $200,000 was not applicable.

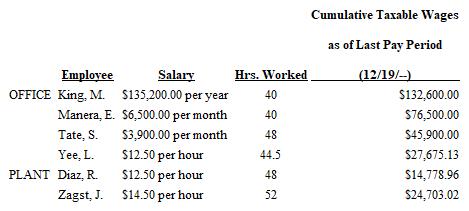

Refer to Instruction 3-1. At Haddon, Inc., the office workers are employed for a 40-hour workweek and are paid on either an annual, monthly, or hourly basis. All office workers are entitled to overtime pay for all hours worked beyond 40 each workweek at 1.5 times the regular hourly rates.

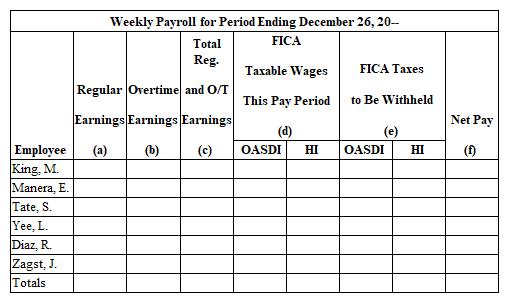

Company records show the following information for the week ended December 26, 20--.  On the form below, calculate for each worker: (a) regular earnings, (b) overtime earnings, (c) total regular and overtime earnings, (d) FICA taxable wages, (e) FICA taxes to be withheld, and (f) net pay for the week ended December 26, 20--. Assume that there are 52 weekly payrolls in 20--. Also, determine the total for each of these six items.

On the form below, calculate for each worker: (a) regular earnings, (b) overtime earnings, (c) total regular and overtime earnings, (d) FICA taxable wages, (e) FICA taxes to be withheld, and (f) net pay for the week ended December 26, 20--. Assume that there are 52 weekly payrolls in 20--. Also, determine the total for each of these six items.

Definitions:

Preemptive Right

A shareholder's right to buy additional shares of a company's stock before it is offered to the public, maintaining their proportional ownership.

Common Stock

Equity ownership in a corporation, giving holders voting rights and a share in the company's profits through dividends and capital appreciation.

Ownership

The state or fact of exclusive rights and control over property, which can be an object, land/real estate, or intellectual property.

Dividend Growth Model

A method for valuing a stock by using predicted dividends and discounting them back to present value.

Q2: Form 944 (annual form) can be used

Q5: All states have set their minimum wage

Q5: A contract that requires the user to

Q8: Warranty exclusions do not have to be

Q17: E-pay or a major debit or credit

Q26: Only one state has passed a law

Q37: The _ environment of your country affects

Q65: Every employer is entitled to a 5.4

Q85: Institutions of higher education are extended coverage

Q116: Michael and Sandy purchased a home for