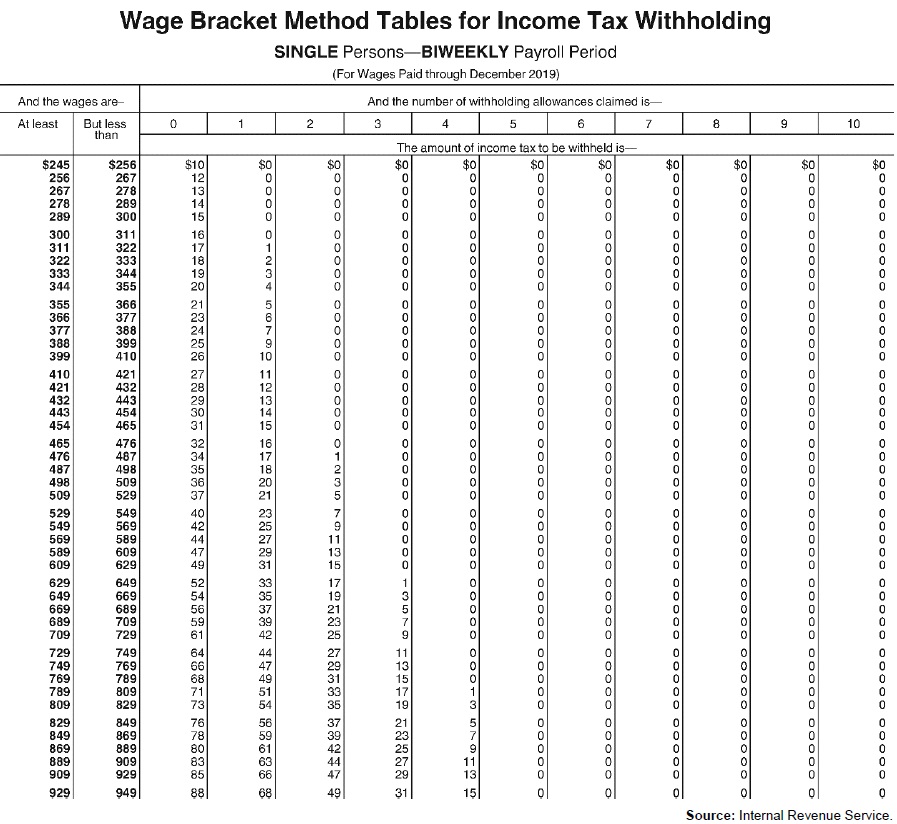

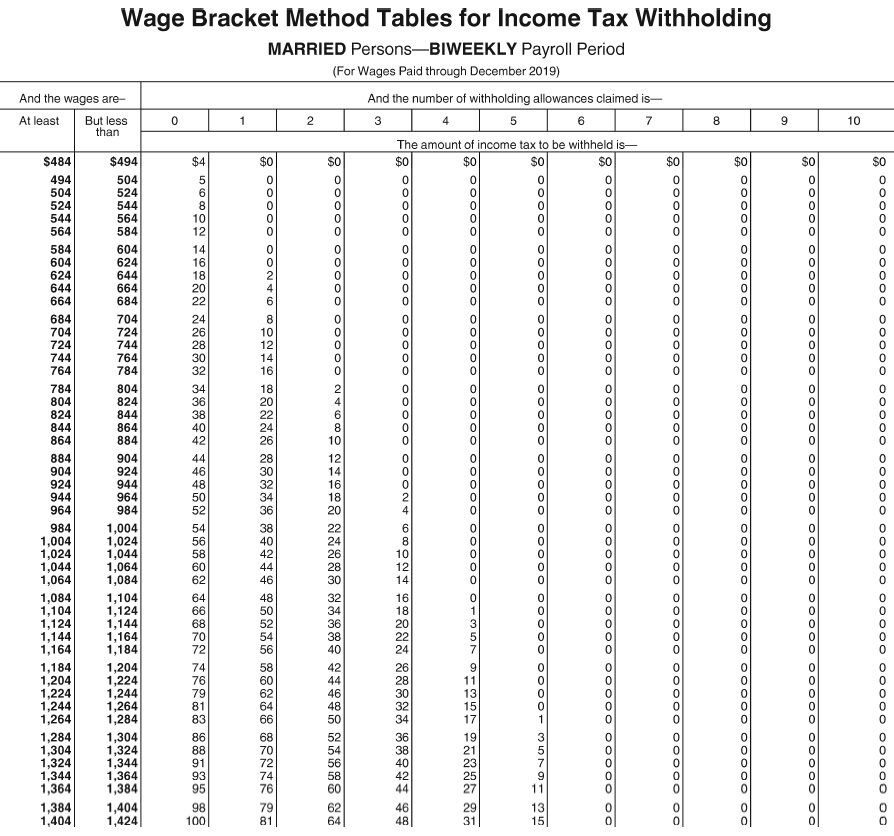

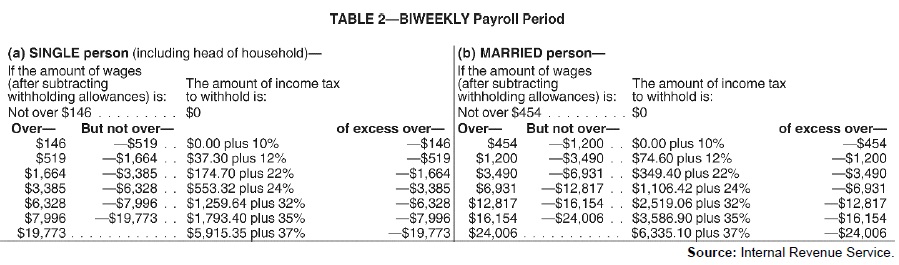

Exhibit 4-1 : Use the following tables to calculate your answers.

Refer to Exhibit 4-1 . Carson Smart is paid $1,200 every two weeks plus a taxable lodging allowance of $100. He is a participant in the company 401(k) plan and has $150 deducted from his pay for his contribution to the plan. He is married with two allowances. How much would be deducted from his pay for federal income tax (using the wage-bracket table)?

Definitions:

Abnormal Variation

A deviation from the common or expected pattern, often used in the context of psychological or physiological conditions that differ significantly from the norm.

Pathological Personality

Personality types or traits that are maladaptive, causing significant impairment or distress to the individual.

Obsessive-compulsive Personality Disorder

A disorder characterized by a pervasive pattern of preoccupation with orderliness, perfectionism, and mental and interpersonal control, at the expense of flexibility, openness, and efficiency.

Avoidant Personality Disorder

A mental health condition characterized by a long-standing pattern of extreme shyness, feelings of inadequacy, and sensitivity to rejection.

Q10: In preparing legal research for a contracts

Q21: The Social Security Act does not require

Q35: Under SECA, all of an individual's self-employment

Q65: Every employer is entitled to a 5.4

Q71: Under FICA, employers must collect the employee's

Q78: In certain circumstances, a FUTA tax payment

Q86: Instructions : Choose the word or phrase

Q106: INSTRUCTIONS: Choose the word or phrase in

Q108: Instruction 2-1 Unless instructed otherwise, compute hourly

Q118: In addition to discussing your financial goals