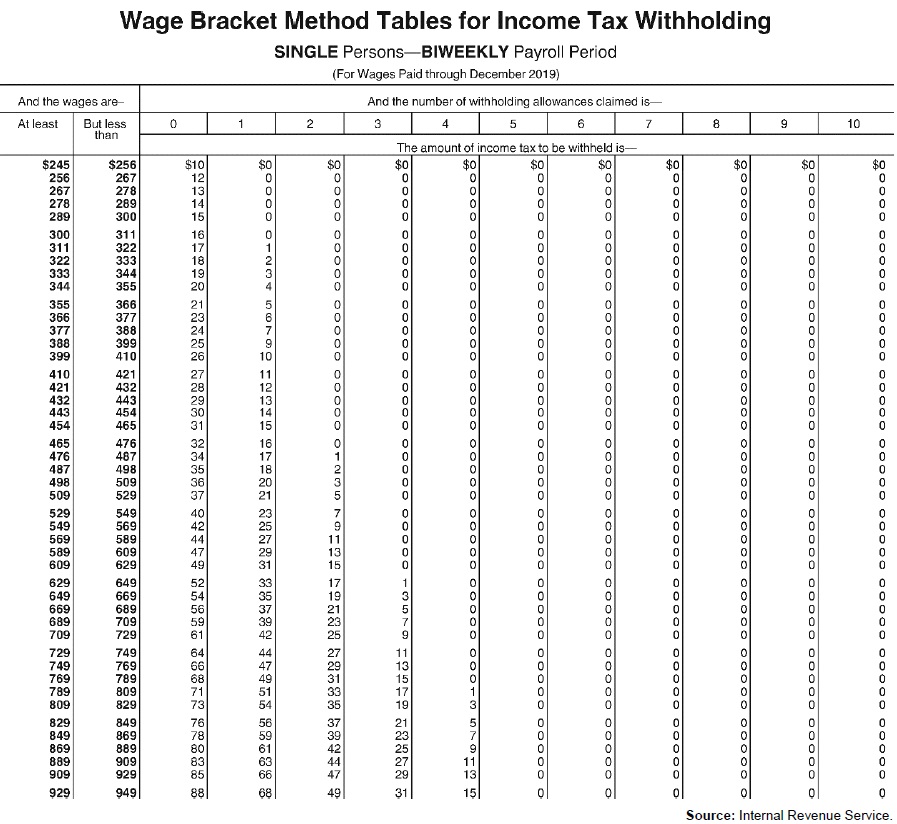

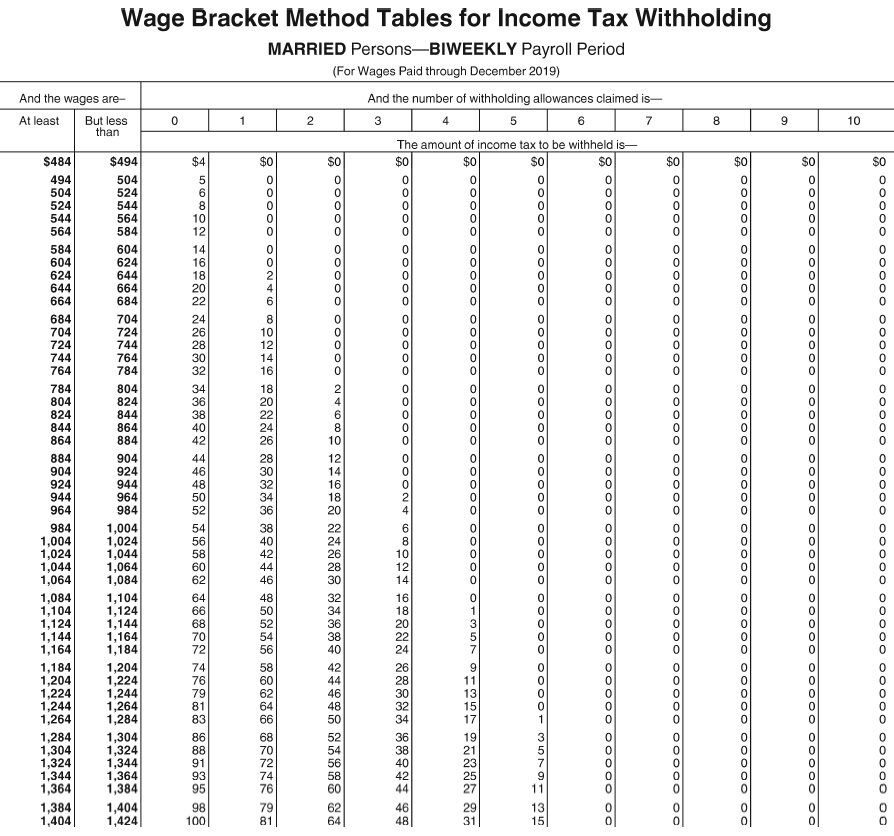

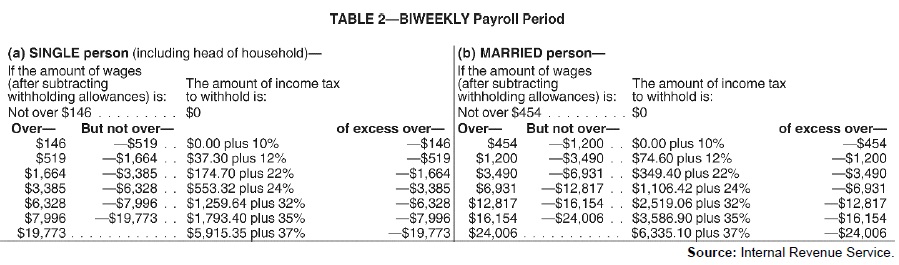

Exhibit 4-1 : Use the following tables to calculate your answers.

Refer to Exhibit 4-1 . Carson Smart is paid $1,200 every two weeks plus a taxable lodging allowance of $100. He is a participant in the company 401(k) plan and has $150 deducted from his pay for his contribution to the plan. He is married with two allowances. How much would be deducted from his pay for federal income tax (using the wage-bracket table)?

Definitions:

Equity Method

A method of accounting in which an investor recognizes its share of the profits and losses of an investee company in its own profit and loss statement, proportional to the investor's share of equity in the investee.

Diluted Earnings Per Share

A metric that calculates a company’s earnings per share considering all potentially convertible securities.

Preferred Stock

A class of ownership in a corporation that has a higher claim on assets and earnings than common stock and usually receives dividends before common shareholders.

Convertible

Refers to a security, usually a bond or a preferred stock, that can be converted into a specified number of shares of common stock.

Q11: It is best to prepare your financial

Q12: The taxes imposed under the Social Security

Q15: In some states, employers may obtain reduced

Q21: Contracts transactions cannot contain both common law

Q35: Your take-home pay is what you are

Q49: Career planning:<br>A) does not require any goal

Q61: A cash budget helps you:<br>A) monitor and

Q98: Bona fide meal periods when the employee

Q109: Personal _ is a systematic process that considers

Q116: Michael and Sandy purchased a home for