Instruction 5-1

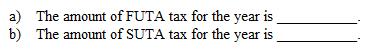

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

Refer to Instruction 5-1 . Niemann Company has a SUTA tax rate of 7.1%. The taxable payroll for the year for FUTA and SUTA is $82,600.

Definitions:

Tools

Devices or implements, often hand-held, used to carry out a particular function or task.

Taxation Systems

The structured methods by which governments finance their expenditure by imposing charges on citizens and corporate entities.

Federal Reserve System

The central banking system of the United States, responsible for setting monetary policy and regulating banks.

Environmental Concerns

Issues related to the protection of natural resources and the impact of human activities on the environment.

Q5: Credit unions are:<br>A) member-owned financial cooperatives.<br>B) mortgage

Q19: Which of the following financial goals is

Q25: Tax plans are closely tied to investment

Q27: A cash budget uses short-term financial goals

Q39: You would typically include _ in your

Q60: Employer contributions for retirement plan payments for

Q75: The most effective way to achieve financial

Q78: In certain circumstances, a FUTA tax payment

Q89: Retirement planning includes taking advantage of and

Q94: The tips received by a tipped employee