Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

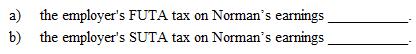

Refer to Instruction 5-1 . Aaron Norman earned $24,900 for the year from Marcus Company. The company is subject to a SUTA tax of 4.7% on the first $9,900 of earnings. Determine:

Definitions:

Jet Fuel

A type of aviation fuel designed for use in aircraft powered by gas-turbine engines.

Hedge

An investment made to reduce the risk of adverse price movements in an asset, typically involving derivatives contracts like futures and options.

American Call Option

A type of options contract that gives the holder the right, but not the obligation, to buy an asset at a set price at any time before the expiration.

Exercise Price

The cost at which the possessor of an option is allowed to purchase (in the case of a call option) or dispose of (in the case of a put option) the asset underneath.

Q1: Instructions : Choose the word or phrase

Q29: A taxpayer can file for an automatic

Q40: As part of their FMLA, a few

Q41: Employers cannot terminate an employee for providing

Q60: The Robertsons, a couple with an adjusted

Q68: A traveling salesperson who solicits and transmits

Q85: Payments made to a worker's spouse for

Q104: Which of the following laws establishes the

Q116: Michael and Sandy purchased a home for

Q121: Instructions : Choose the word or phrase