Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

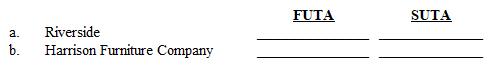

Refer to Instruction 5-1 . Ted Carman worked for Rivertide Country Club and earned $28,500 during the year. He also worked part time for Harrison Furniture Company and earned $12,400 during the year. The SUTA tax rate for Rivertide Country Club is 4.2% on the first $8,000, and the rate for Harrison Furniture Company is 5.1% on the first $8,000. Calculate the FUTA and SUTA taxes paid by the employers on Carman's earnings.

Definitions:

Mandatory Helmet

A rule or law requiring individuals to wear helmets while engaging in certain activities, such as cycling or motorbiking, to reduce the risk of head injuries.

Quasi-experimental Design

A research design that lacks the full control of true experimental designs but still includes an intervention or treatment.

Admission Fee

The charge or fee required to enter a facility, event, or establishment.

Park Ranger

A professional responsible for protecting and preserving natural parks and wilderness areas, often involved in conservation, education, and law enforcement activities.

Q10: "Dumping" is legal in all but a

Q11: It is best to prepare your financial

Q33: Truson Company paid a 4% SUTA tax

Q50: For FUTA purposes, an employer can be

Q53: A retail shop may employ a full-time

Q61: Employers must withhold FICA taxes on payments

Q64: The location of the employee's residence is

Q77: Every employer has the right to choose

Q86: The deadline for an employee to complete

Q87: When Phil lists his house on his