Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

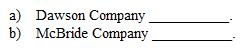

Refer to Instruction 5-1 . Michael Mirer worked for Dawson Company for six months this year and earned $11,200. The other six months he earned $6,900 working for McBride Company (a separate company). The amount of FUTA taxes to be paid on Mirer's wages by the two companies is:

Definitions:

Effect Size

A quantitative measure of the magnitude of a phenomenon or the strength of the relationship between variables.

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is actually true, typically set at 0.05 or 5%.

Degrees of Freedom

Represents the number of independent pieces of information available to estimate another piece of information or parameter in a dataset.

Test Statistic

A value calculated from sample data during a hypothesis test, used to decide whether to reject the null hypothesis.

Q5: Which of the following statements regarding the

Q18: INSTRUCTIONS: Choose the word or phrase in

Q19: INSTRUCTIONS: Choose the word or phrase in

Q31: Under the Family and Medical Leave Act,

Q39: Inflation is expected to be 4% in

Q54: Withholding allowance certificates must be retained by

Q58: Gere became the father of triplets on

Q68: Elena purchased a stamp collection for $5,000

Q71: If your statement of income and expense

Q81: INSTRUCTIONS: Choose the word or phrase in