Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

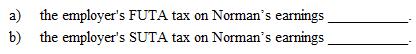

Refer to Instruction 5-1 . Aaron Norman earned $24,900 for the year from Marcus Company. The company is subject to a SUTA tax of 4.7% on the first $9,900 of earnings. Determine:

Definitions:

Shipper and Carrier

A shipper is a person or company sending goods; a carrier is the party responsible for the transport of those goods.

Contract

A legally binding agreement between two or more parties that is enforceable by law.

Environmental Performance

Refers to an organization’s impact on the environment, including the ways in which it manages resources and waste to mitigate harmful effects.

Cost Reductions

Strategies and actions taken to lower expenses and improve efficiency.

Q14: Form 940 can also be used to

Q16: Employers may adopt the practice of recording

Q17: Beech refuses to state her marital status

Q23: On payday, Friday, a semiweekly depositor has

Q25: Tax plans are closely tied to investment

Q27: Which of the following is not required

Q46: Sarah starts investing in an individual retirement

Q51: You can have an account with a

Q86: You made an error when you filed

Q97: A(n) _ is an example of a