Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

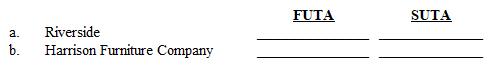

Refer to Instruction 5-1 . Ted Carman worked for Rivertide Country Club and earned $28,500 during the year. He also worked part time for Harrison Furniture Company and earned $12,400 during the year. The SUTA tax rate for Rivertide Country Club is 4.2% on the first $8,000, and the rate for Harrison Furniture Company is 5.1% on the first $8,000. Calculate the FUTA and SUTA taxes paid by the employers on Carman's earnings.

Definitions:

Tone

The attitude or mood conveyed by words in writing or speech, reflecting the feelings of the author or speaker.

Proofreading

The process of reading texts to find and correct grammatical, typographical, or stylistic errors.

Design Mistakes

Errors or flaws in the creation process that can negatively impact the usability, aesthetics, or functionality of a product or document.

Layout Errors

Mistakes or issues in the arrangement or planning of elements in a given space.

Q9: The employer's payroll tax expenses are recorded

Q10: The Uniform Commercial Code modifies the <br>A)firm

Q11: Employers file Form 941 with the IRS

Q21: The Internal Revenue Service (IRS) will compute

Q33: Violators of the overtime provision of the

Q51: You can have an account with a

Q86: Services performed in the employ of a

Q88: Domestics are excluded from coverage under the

Q95: Under the continental system of recording time,

Q113: It is easy to change your partner's