Instruction 5-1

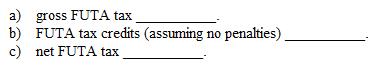

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

Refer to Instruction 5-1 . Queno Company had FUTA taxable wages of $510,900 during the year. Determine its:

Definitions:

Fixed Cost

Expenses that do not change with the amount of goods or services produced, such as rent, salaries, and insurance premiums.

Cartel

An agreement among competing firms to control prices or exclude entry of a new competitor in a market.

Industry Price

The general cost at which goods or services are sold within a particular industry, influenced by supply, demand, and competition.

Marginal Cost

The added expense required to produce one more unit of a product or service.

Q6: If an employee files an amended W-4,

Q14: Employees who regularly receive cash tips of

Q17: When an individual gives his or her

Q27: A cash budget uses short-term financial goals

Q34: Negotiable order of withdrawal (NOW) accounts manage

Q40: The payroll register is used by employers

Q53: FICA excludes from coverage all of the

Q66: Recessions and financial crises will always result

Q91: An employer's portion of social security and

Q114: If your annual budget shows a deficit,