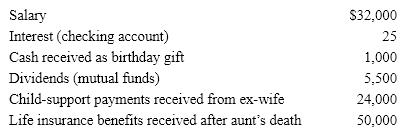

From the following information, determine Steve's gross income for tax purposes.

Definitions:

Put Option

A put option is a financial contract that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

Exercise Price

The predetermined price at which the holder of an option can buy (in case of a call option) or sell (in case of a put option) the underlying asset.

Stock Price

The cost of purchasing a share of a company, reflecting the market's valuation of the company's future earnings potential.

Standardized Options

Options that have been standardized by an options exchange, detailing the specific terms such as expiration date and strike price.

Q6: INSTRUCTIONS: Choose the word or phrase in

Q21: On an adjustable-rate mortgage (ARM), the percentage

Q31: A(n) _ is traditionally a non-interest-paying demand

Q32: Employers often provide _ life insurance as

Q50: When your assets exceed your liabilities, you:<br>A)

Q52: Laura has a $100,000 balance in her

Q55: An employee's marital status and number of

Q68: INSTRUCTIONS: Choose the word or phrase in

Q78: When a savings bank is a mutual

Q84: Which of the following is a nondepository