Vignette #1 Jack has just returned from the hospital where his father is recovering from a heart attack. The doctors told Jack that his dad's atherosclerosis is very serious. Jack and his wife, Melanie, are worried about Jack's father and also are starting to think about Jack's risk of having heart disease in his lifetime. He sets up an appointment at his doctor's office and has his blood lipid levels evaluated for the first time. Let's see if you can answer some of the questions that Jack and Melanie have.

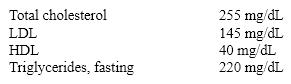

Jack's results from his blood lipid level test are as follows:

Which statement accurately describes Jack's test results?

Definitions:

Consolidated Financial Statements

Financial statements that present the assets, liabilities, and operating results of a parent company and its subsidiaries as one entity.

Beginning Inventory

The value of all inventory held by a company at the start of an accounting period.

Ignoring Income Taxes

Refers to the accounting practice or principle where income taxes are not considered in the calculation of financial metrics or performance evaluations.

Deferred Tax Asset

A tax reduction amount that can be used to offset future taxable income, arising from temporary differences between book and tax income.

Q15: What structure controls the flow of chyme

Q24: Vignette #2 Maggie and her mom are

Q26: Carbohydrate absorption, as well as most carbohydrate

Q38: Vignette While waiting for a prescription to

Q50: Phytochemicals have several different modes of action.

Q61: What substance neutralizes the acidic chyme once

Q74: One of the functions of vitamin C

Q78: Vignette While waiting for a prescription to

Q80: People from which ethnic background tend to

Q88: What is the meaning of the term