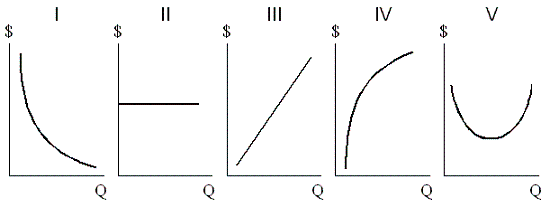

Exhibit 6-13 Cost curves

In Exhibit 6-13, AFC is shown by the graph labeled:

Definitions:

Payroll Tax Expense

Payroll tax expense is the employer's cost associated with taxes based on employee wages, including Social Security and Medicare taxes.

Payroll Tax

Levies placed on employers and employees, often determined as a fraction of the payroll expenses employers incur for their staff.

Workers' Compensation Insurance

Insurance that provides medical benefits and wage replacement to employees injured in the course of employment.

Payroll Amounts

The total sum of money an employer is obligated to pay its employees for a set period or on a given date.

Q2: Which of the following factors is not

Q3: In the country of Bora Bora, consumers

Q22: At the level of output where the

Q25: If a government imposed price ceiling legally

Q42: A good example of a price floor

Q44: Of the following demographic groups, which has

Q46: When firms advertise their products, they are

Q64: A farm is able to produce 5,000

Q90: If a government tax has as its

Q123: Exhibit 4-3 Supply and demand curves <img