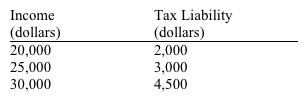

Use the table below to choose the correct answer.  The marginal tax rate on income in the $20,000 to $25,000 range is

The marginal tax rate on income in the $20,000 to $25,000 range is

Definitions:

Depreciation Expense

An accounting method that allocates the cost of a tangible asset over its useful life, representing the wear and tear, deterioration, or obsolescence of the asset.

Interest Expense

The cost incurred by an entity for borrowed funds over a period of time, typically reported on the income statement.

Times Interest Earned

A financial ratio that measures a company's ability to meet its debt obligations based on its current income.

Q11: Suppose external benefits are present in a

Q40: Figure 2-9 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 2-9

Q41: Use the figure below to answer the

Q75: Figure 5-4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 5-4

Q99: The actual incidence (or burden) of a

Q173: In a market economy, which of the

Q183: Figure 3-17 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 3-17

Q211: Which of the following is a function

Q214: If Mateo is paid $25,000 to sell

Q251: Other things constant, an increase in the