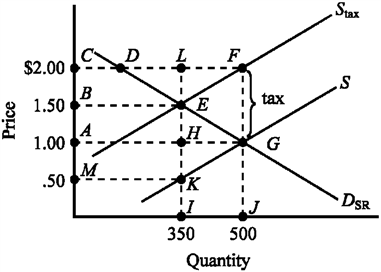

Use the figure below illustrating the impact of an excise tax to answer the following question(s) . Figure 4-6 Refer to Figure 4-6. The amount of the actual tax burden paid by consumers and producers is

Refer to Figure 4-6. The amount of the actual tax burden paid by consumers and producers is

Definitions:

Accounts Payable

Money owed by a company to its suppliers or vendors for goods or services received but not yet paid for.

Current Liability

Short-term financial obligations that are due within one year or within a normal operating cycle.

Current Assets

Assets expected to be converted into cash, sold, or consumed within a year or within the operating cycle of a business.

Federal Unemployment Taxes

Taxes paid by employers to fund the federal government's oversight of the state unemployment insurance programs.

Q33: Public choice theory assumes voters, politicians, and

Q66: Figure 3-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 3-22

Q109: Use the figure below to answer the

Q123: Legislators often gain by bundling a number

Q125: What are the two distinguishing characteristics of

Q126: If the United Auto Workers union can

Q131: A local government operates a city recreation

Q148: When voters pay taxes in proportion to

Q190: In which statement(s) are "demand" and "quantity

Q242: Which of the following would most likely