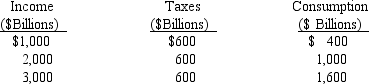

Use the table below to find the marginal propensity to consume.

Definitions:

Proprietorships

A business structure owned by a single individual who is responsible for its liabilities and entitled to its profits.

Corporate Income Tax

A tax imposed on the net income or profit of corporations and other business entities.

Progressive

A tax system where the tax rate increases as the taxable amount increases, making it more burdensome for higher earners.

Excess Burden

The excess burden of a tax is the cost to society in economic welfare that exceeds the revenue raised by the government, often due to distorted market behaviors.

Q14: Half of American recessions since the early

Q29: Which of the following events triggered intense

Q35: Which of the following is an injection

Q35: Which of the following could cause a

Q36: The Fed has decreased the money supply.The

Q62: In the classical model,the demand for loanable

Q99: Assuming the economy was in equilibrium,use

Q105: Government expenditures are a subcategory of government

Q105: Which of the following could shift the

Q124: Which of the following types of unemployment