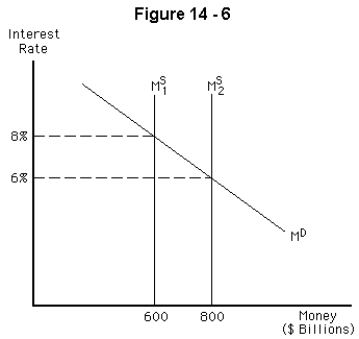

-Refer to Figure 14-6.Suppose the Fed increases the money supply (to ) .As a result,the interest rate falls initially to 6 percent.After spending and GDP change,what will happen to the interest rate?

Definitions:

Cash Flow Statement

A financial document summarizing the total cash received from a company's operational activities and external financial sources, alongside all expenditures on business operations and investments over a specific timeframe.

Accounts Receivable

Money owed to a business by its customers for goods or services that have been delivered or used but not yet paid for.

Accounts Payable

Accounts payable is the amount a company owes to suppliers or vendors for goods or services received but not yet paid for, representing a short-term liability.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating the efficiency of a company in managing its production and labor costs.

Q2: The Federal Reserve<br>A) prints money for use

Q4: If the Federal Reserve buys $1,000 in

Q31: When the Federal Reserve System was first

Q43: Whenever spending changes,which of the following dampens

Q83: The aggregate demand curve identifies the level

Q101: A household's quantity of money demanded is

Q118: Newspaper reports about good news in the

Q133: If the dollars per pound exchange rate

Q207: Given the balance sheet below and assuming

Q220: The standard measure of the money stock,M1,refers