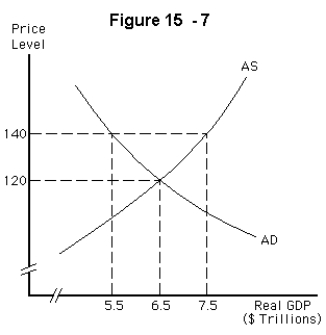

-Refer to Figure 15-7.If the economy is currently at a price level of 120 and real GDP is $6.5 trillion,an increase in taxes will,in the short run,

Definitions:

Marginal Tax Rate

The rate at which an additional dollar of income is taxed, representing the percentage of tax applied to the last dollar earned.

Tax-Free

Tax-free describes goods, transactions, or income that are not subject to taxation by the government.

Taxed

Subjected to a financial charge or levy by a government on income, goods, or activities.

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, resulting in those who have higher incomes being taxed at a higher rate.

Q2: The strategy of an integrative approach to

Q26: Distributive bargaining _ form of negotiation.<br>A)Win-win.<br>B)Lose-win.<br>C)Win-lose.<br>D)Lose-lose.

Q28: If the U.S.inflation rate is 3 percent

Q29: Which of the following is not an

Q46: After a negative demand shock,what are the

Q121: If Americans buy 100 million British pounds

Q124: Moral hazard is a problem for the

Q126: Which of the following would lead to

Q130: Which of the following would shift the

Q135: In its day-to-day operations,the Fed focuses on<br>A)