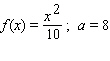

Calculate the average rate of change of the given function over the intervals  , where h = 1, 0.1, 0.01, 0.001, and 0.0001. (It will be easier to do this if you first simplify the difference quotient ( dq ) as much as possible.)

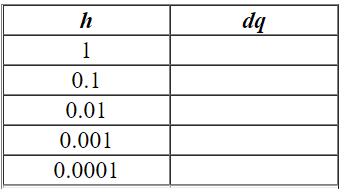

, where h = 1, 0.1, 0.01, 0.001, and 0.0001. (It will be easier to do this if you first simplify the difference quotient ( dq ) as much as possible.)  Complete the table.

Complete the table.

Definitions:

Capital Asset

An asset of any kind owned for investment or personal purposes, not usually sold in the course of business.

Household Furnishings

Items and accessories used for decorating and living in a home, such as furniture, rugs, and appliances.

Business Inventory

Items that are held for sale in the ordinary course of business, representing a current asset on a company's balance sheet.

Section 1231 Property

Business property that combines features of capital assets and depreciable property, potentially offering favorable tax treatment on gains.

Q2: Which of the following Object constructor methods

Q18: The following graph shows the actual percentage

Q20: The _ object method returns a text

Q25: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Evaluate the

Q27: Calculate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Calculate .

Q45: Graph shows the number of sports utility

Q49: The table below is filled correctly. Exponential

Q74: The regular expression for 4-digit CVC numbers

Q79: Evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Evaluate for

Q113: Use the given tabular representation of the