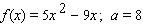

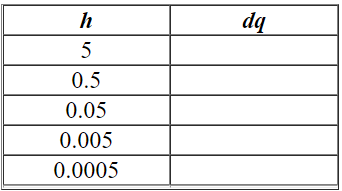

Calculate the average rate of change of the given function f over the intervals  , where h = 5, 0.5, 0.05, 0.005, and 0.0005. (It will be easier to do this if you first simplify the difference quotient ( dq ) as much as possible.)

, where h = 5, 0.5, 0.05, 0.005, and 0.0005. (It will be easier to do this if you first simplify the difference quotient ( dq ) as much as possible.)  Complete the table.

Complete the table.

Definitions:

Nontrade Receivables

Monies owed to a company that are not related to the sale of goods or services, such as loans to employees.

Loans

Loans refer to borrowed money that must be repaid with interest by the borrower to the lender, used typically for personal, business, or education purposes.

Allowance for Doubtful Accounts

A contra-asset account that reduces total accounts receivable to reflect the estimated amount of credit sales that may not be collected.

Credit Balance

A positive balance within an account, indicating that a company or individual has received more in deposits than it has spent.

Q3: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Evaluate the

Q16: Which of the following methods is applied

Q23: For the differential equation, find the particular

Q23: A prototype chain is created by defining

Q23: A general exponential demand function has the

Q39: for…in loops do not follow a specific

Q45: Graph shows the number of sports utility

Q61: Estimate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Estimate of

Q70: The given table corresponds to the function

Q83: Compute <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Compute .