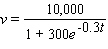

You manage a small antique store that owns a collection of Louis XVI jewelry boxes. Their value v is increasing according to the formula  where t is the number of years from now. You anticipate an inflation rate of 2% per year, so that the present value of an item that will be worth $ v in t years time is given by

where t is the number of years from now. You anticipate an inflation rate of 2% per year, so that the present value of an item that will be worth $ v in t years time is given by  In how many years from now will the greatest rate of increase of the present value of your antiques be attained?

In how many years from now will the greatest rate of increase of the present value of your antiques be attained?

Definitions:

Contract Is Signed

The formal agreement between parties becomes legally binding when all necessary signatures are affixed to the document.

Cash Flow From Assets

The total amount of money being transferred into and out of a company's assets, indicating the company's financial health and operational efficiency.

Operating Cash Flow

The cash generated by a company's normal business operations, reflecting its ability to generate sufficient cash to meet its needs.

Net New Borrowing

Net new borrowing is the difference between the amounts a company borrows and repays during a specific period, reflecting changes in its debt level.

Q5: A market-oriented economic system provides an environment

Q8: The marginal cost of producing the x

Q9: Evaluate the integral mentally. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Evaluate

Q11: Find the exact location of all the

Q24: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Find using

Q27: Calculate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Calculate .

Q43: The monthly sales of Sunny Electronics new

Q94: Evaluate the following derivative. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Evaluate

Q100: For the given differential equation,find the particular

Q112: The function given below gives the cost