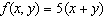

Sketch the graph of the function.

Definitions:

FICA Tax

Federal Insurance Contributions Act tax, which funds Social Security and Medicare, jointly paid by employees and employers.

Employer

An entity or individual that hires and pays for the services of an employee or contractor.

Withholding Allowances

Amounts that taxpayers can claim to reduce the federal income tax withheld from their paycheck, based on their expected tax deductions and credits.

FICA Taxes

Taxes collected under the Federal Insurance Contributions Act, funding Social Security and Medicare, required to be paid by both employees and employers.

Q1: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Evaluate the

Q6: Based on 2018 tax schedules, the highest

Q6: A venture opportunity screening is the same

Q19: Model the curve with a cosine function.

Q22: The annual net sales (revenue)earned by the

Q32: Calculate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Calculate .

Q41: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Evaluate the

Q53: The Pentagon is planning to build a

Q58: Find the derivative of the function. <img

Q71: Estimate the derivative of the function <img