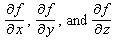

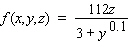

Calculate the values of  at

at

Definitions:

Short-Term Capital Loss

A loss realized from the sale of a capital asset, such as stock, held for one year or less, which can be used to offset capital gains for tax purposes.

Ordinary Loss

A loss incurred in the regular course of business or through investments, which can be used to offset ordinary income for tax purposes.

Section 1231 Loss

A loss from the sale or exchange of property used in a trade or business that can be deductible for tax purposes.

Section 1231 Property

Refers to a type of property, both tangible and depreciable, used in a business and held for more than one year, which qualifies for tax treatment that combines aspects of capital gains and ordinary income tax rates.

Q4: Calculate the derivative. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Calculate the

Q6: Calculate the derivative. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Calculate the

Q9: Find the general solution of the differential

Q19: Model the curve with a cosine function.

Q33: Beginning in 2018, the income tax laws

Q35: Business angels typically invest in:<br>A)early-stage ventures<br>B)rapid-growth stage

Q39: Use the addition formulas: sin ( x

Q52: Free cash flow to equity is the

Q56: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="Find using

Q94: When conducting a SWOT analysis, assessing unfilled