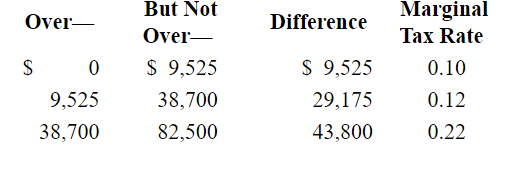

Following is a partial personal taxable income schedule for a single filer:  The average tax rate for a single filer with taxable income of $38,700 would be:

The average tax rate for a single filer with taxable income of $38,700 would be:

Definitions:

Irritability

A heightened state of sensitivity or annoyance that can result from stress, lack of sleep, or other factors, leading to a quick temper or frustration.

Depression

A mental health disorder characterized by persistently depressed mood or loss of interest in activities, causing significant impairment in daily life.

Circadian Rhythm

The physical, mental, and behavioral changes that follow a 24-hour cycle, primarily responding to light and darkness in an organism's environment.

Body Temperature

The measure of the body's ability to generate and get rid of heat, vital for maintaining metabolic processes.

Q24: Using the following information, determine the average

Q30: The weighted average cost of capital is

Q32: Expenses or costs that vary directly with

Q38: or the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8650/.jpg" alt="or the

Q54: The balance sheet equation is: Total Assets

Q67: A private placement, or a transaction by

Q71: Locate the maximum of the function. <img

Q77: GAAP stands for "generally accepted accounting principles."

Q88: Which of the following does not describe

Q127: Suppose your newspaper is trying to decide