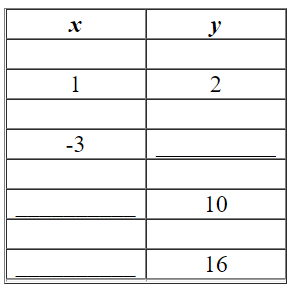

For the equation complete the given table.

Definitions:

Federal Income Tax

A tax levied by the federal government on individuals' and corporations' yearly income.

Payroll Tax

Taxes imposed on employers and employees, typically calculated as a percentage of the salaries that employers pay their staff.

Benefits Principle

A tax principle stating that those who benefit from government services should pay in proportion to the amount they benefit.

Ability-To-Pay

A principle in taxation that suggests taxes should be levied according to the taxpayer's ability to bear the tax burden.

Q11: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8806/.jpg" alt="Solve the

Q32: Graph the line that passes through the

Q80: Simplify. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8806/.jpg" alt="Simplify. A)

Q97: Ms. Hagan invested twice as much money

Q111: For the following problem, the slope and

Q138: Graph the points (-2, 4)and (2, -4)and

Q148: Find the equation of the line that

Q201: Fill in the table below to find

Q224: A stockbroker has money in three accounts.

Q283: Perform the indicated operations. Simplify as much