Factor.

Definitions:

State Income Taxes

Taxes levied by individual states on the income earned by residents and non-residents who receive income from a source in the state.

Itemized Deduction

Deductions from taxable income that individuals can claim for specific expenses as outlined by tax laws, which can include things like medical expenses, charitable contributions, and mortgage interest.

Taxes Withheld

Amounts taken out of an employee's wages or payments by the employer and paid to the government as part of the individual's tax liabilities.

Deductible Charitable Contribution

A financial donation to a qualified organization that can be subtracted from one's gross income for tax purposes.

Q7: Solve the system by solving one of

Q25: The higher you are above the ground,

Q32: Multiply binomials using the FOIL method. <img

Q89: Factor the expression completely. Look first for

Q92: Factor the polynomial by grouping the terms

Q101: Assume all variables are positive, and find

Q124: Solve the system by solving one of

Q133: Perform the division (find the quotient). <img

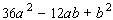

Q253: Factor. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8806/.jpg" alt="Factor. " class="answers-bank-image

Q290: The equation is already in factored form.