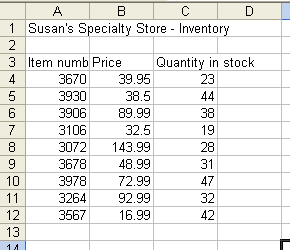

Susan is the owner of a specialty goods store. To keep a record of the goods that she has in stock and their prices, she has created the worksheet shown below. But she is not familiar with the formatting features of Excel and has asked you for help.  You now need to further format the worksheet title and resize all the columns. a) Write the procedure for centering and merging the worksheet title over the columns A, B, C, and

You now need to further format the worksheet title and resize all the columns. a) Write the procedure for centering and merging the worksheet title over the columns A, B, C, and

d. b) Write the procedure for resizing columns A, B, and C using the AutoFit feature so that the widest entry in each column fits.

Definitions:

Book Value

Book Value is the value of an asset as recorded on the company's balance sheet, representing the asset's cost minus accumulated depreciation or amortization.

Deferred Tax Asset

An accounting term used to describe a situation where a company has paid more taxes to the government than it has shown as an expense in its financial statements, which can be used to reduce future tax liability.

Capital Cost Allowance

A tax deduction available in some jurisdictions for tangible and intangible assets, allowing businesses to write off the cost of assets over their useful life.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in a linear fashion, resulting in a constant annual depreciation expense.

Q7: Queries evaluate multiple sort fields in a

Q7: _ controls are used to display and

Q13: In Word, the _ Link command is

Q36: Explain why you would add colors, patterns,

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9074/.jpg" alt=" If you click

Q40: To find all records where there is

Q43: What is meant by the format of

Q50: To reply to everyone who has received

Q59: Jennifer Westin works as an administrative assistant

Q61: What does the Format Painter button do?