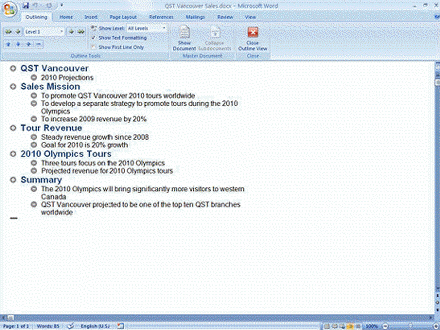

Mary Lou Jacobs has just asked you to create a PowerPoint slide presentation to be delivered at the next sales meeting. She expects you to construct the presentation slide by slide based on data in a Word document. You offer an faster alternative: importing the Word outline shown in the figure below into PowerPoint. Ms. Jacobs has several questions about the process.  Are there any limitations to this method of creating a PowerPoint presentation?

Are there any limitations to this method of creating a PowerPoint presentation?

Definitions:

Break-Even Point in Units

The point at which sales volumes result in no profit or loss, calculated by dividing fixed costs by the contribution margin per unit.

Unit Fixed Cost

The fixed cost associated with manufacturing one unit of a product, which remains constant regardless of the number of units produced.

Unit Variable Cost

The variable cost associated with producing one unit of product, including materials, labor, and other costs that vary with production volume.

Variable Costing

A bookkeeping approach that incorporates solely variable production expenses such as direct materials, direct labor, and variable manufacturing overhead into the costs of products, while omitting fixed overhead.

Q1: PowerPoint has access to many professionally designed

Q1: A text box and a digital image

Q2: To open the Clipboard task pane in

Q14: The _ bar provides access to most

Q18: You insert a comment in a worksheet

Q31: You frequently need to manage the links

Q38: When you copy a range, a moving

Q42: Gradient background styles can be applied to

Q48: SUM and AVERAGE are examples of _.<br>A)

Q59: You link an object to a PowerPoint