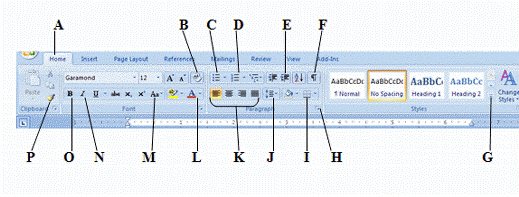

In the figure above, the button labeled B is used to erase text.

In the figure above, the button labeled B is used to erase text.

Definitions:

Cotton

A natural fiber and a commodity traded globally, used primarily in the textile industry.

Profit Or Loss

The financial result of a company’s operations and activities for a specific period, indicating the difference between revenues and expenses.

Wheat Futures Contracts

A standardized contract to buy or sell a specific amount of wheat at a future date, used for hedging or speculative purposes in the commodities market.

Payoff

The return or final outcome received from an investment, which could be positive or negative.

Q8: The _ displays information about open programs,

Q16: An area of a city in which

Q19: A software program that includes tools for

Q23: The Identification Division of the FBI is

Q45: Explain the differences between strict liability, intentional

Q46: Police dogs are generally cross-trained extensively so

Q49: Almost all computer crimes are eventually prosecuted.

Q53: _ (also called operations or line services)

Q57: To shrink a window to a button

Q68: A(n) _ is an electronic collection of