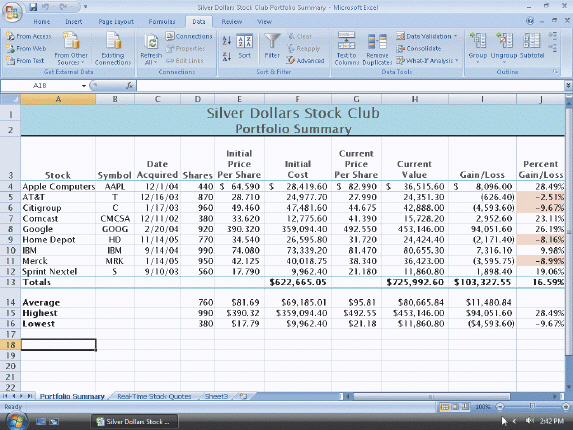

Figure 2-1 In the accompanying figure, the two middle scroll buttons to the left of the sheet tabs move to the first or last worksheet in the workbook.

Figure 2-1 In the accompanying figure, the two middle scroll buttons to the left of the sheet tabs move to the first or last worksheet in the workbook.

Definitions:

Deferred Taxes

Taxes that are incurred in one period but are not paid until a future period, often due to timing differences between accounting and tax reporting.

Taxable Entity

A business or individual that is required to pay taxes to a federal, state, or local government.

Permanent Difference

These are differences between taxable income and accounting income that originate in one period and do not reverse over time, affecting taxable income and tax liability.

Temporary Difference

A discrepancy between the tax base of an asset or liability and its carrying amount on the balance sheet that results in taxable or deductible amounts in future years.

Q13: A Web page can contain text, graphics,

Q18: If the TAB key is used to

Q20: In addition to any hyperlinks that are

Q44: To import an Excel worksheet, use the

Q46: To calculate statistics for only those records

Q53: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9073/.jpg" alt=" Figure 3-1 In

Q72: To display the Join Properties dialog box,

Q79: To freeze both column headings and row

Q90: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9073/.jpg" alt=" Figure 2-4 To

Q93: Each time you open a message, the