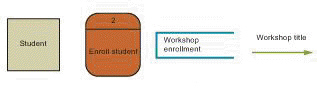

The items in the figure above are symbols from a(n) ____________________.

The items in the figure above are symbols from a(n) ____________________.

Definitions:

Freedom Of Speech

The right to express information, ideas, and opinions free of government restrictions based on content and subject only to reasonable limitations.

Eighth Amendment

Part of the U.S. Constitution's Bill of Rights that prohibits the federal government from imposing excessive bail, excessive fines, or cruel and unusual punishment.

Recidivism

The tendency of a convicted criminal to reoffend, typically measured by the occurrence of subsequent criminal behavior.

Nulla Poena Sine Lege

A legal principle meaning "no penalty without a law," indicating one cannot be punished for doing something that is not prohibited by law.

Q15: What information is usually found on elevation

Q24: A repetition control structure is sometimes referred

Q37: The process of passing certain characteristics from

Q43: The life cycle of a new computer

Q76: Some products, referred to as dreamware ,

Q105: A _ watermark is a pattern of

Q125: A method is activated by a(n) _,

Q130: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9143/.jpg" alt=" As shown in

Q166: A(n) _ converts a printed image into

Q170: It is easier to edit an object