Multiple Choice

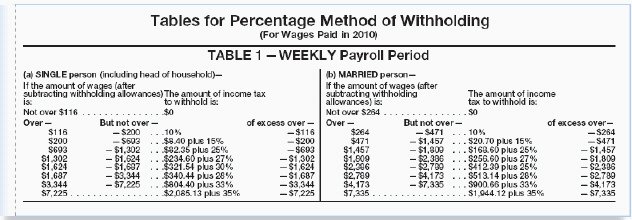

Attus Nasos is married with five allowances. He has gross weekly earnings of $1,175. For each withholding allowance, he can deduct $70.19 from his gross earnings. Use the percentage method table to find the amount of weekly federal income tax withheld.

Definitions:

Related Questions

Q6: The lowest temperature ever recorded on Earth

Q14: Which of the following is the most

Q16: Mr. and Mrs. Woodard are going to

Q22: One way to ensure against irradiating a

Q27: Melissa has 15/30/5 liability insurance. She has

Q27: Nigay earns a biweekly salary of $830

Q30: Which is <span class="ql-formula" data-value="\frac

Q33: Tony Lyons bought a new furnace for

Q36: Which is <span class="ql-formula" data-value="4

Q36: Tony has a thermometer that displays both