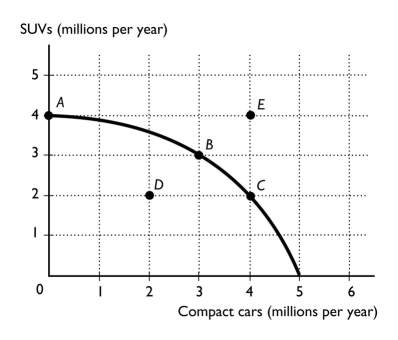

-The figure above shows the production possibilities frontier for a country.In order for it to move from producing at point A to producing at point B,the country would need to incur an opportunity cost of

Definitions:

Risk-Free Return

The theoretical return of an investment with zero risk, often represented by the yield of government bonds like U.S. Treasury bonds.

Betas

A metric that assesses the systematic risk or volatility faced by a security or portfolio in contrast to the entire market.

Sharpe Measure

A ratio used to evaluate the risk-adjusted performance of an investment, considering both the return and the volatility of the investment.

Risk-Free Return

The theoretical return on investment with no risk of financial loss, typically associated with government bonds.

Q43: The figure above shows a production possibilities

Q58: The above figure shows the production possibility

Q85: Compared to the developing economies,the advanced economies

Q189: The total amount the federal government has

Q195: Rather than go out to eat by

Q216: Consumers regard Dell computers and Apple computers

Q219: The slope of a line equals the

Q223: In the above figure,as the y variable

Q237: The above figure shows the market for

Q311: An increase in both the equilibrium price