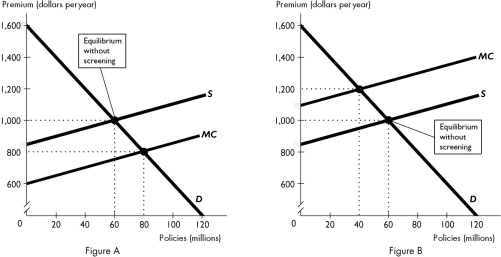

The figures show two auto insurance markets, one market for safe drivers and one market for aggressive drivers.

-In a pooling equilibrium,there is ________ of insurance in the market for safe drivers,and there is ________ of insurance in the market for aggressive drivers.

Definitions:

Depreciation Expense

A non-cash charge that reduces the value of an asset over time due to use, wear and tear, or obsolescence.

Residual Value

The estimated value of an asset at the end of its useful life, determining the depreciation amount to be allocated during the asset's lifespan.

Composite Rate

A single interest rate that reflects the combination of rates applied to several different financial transactions or loans.

Q2: Any point above a given indifference curve

Q35: If the price of a soda is

Q77: The marginal rate of substitution is equal

Q118: Paul and Paula are the only members

Q156: Reb buys fishing lures and steaks.If his

Q211: Producing leather creates external costs in the

Q240: If a product has an external benefit,how

Q248: When the price of a good a

Q277: The solution to the paradox of value

Q278: Based on the figure above,on which budget