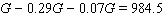

If 29% of your monthly pay is withheld for federal income taxes and another 7% is withheld for Social Security, state income tax, and other miscellaneous items, leaving you with $984.50 a month in take-home pay, then the amount you earned before the deductions were removed from your check is given by the equation  . Solve this equation to find your gross income. Round the answer to the nearest dollar. $ __________ per month

. Solve this equation to find your gross income. Round the answer to the nearest dollar. $ __________ per month

Definitions:

Direct Materials

The cost of raw materials that can be directly traced to the production process.

Materials Price Variance

The difference between the actual cost of materials used in production and the expected standard cost, which can indicate changes in material costs over time.

Particular Product

A specific item produced by a company, distinguished by its unique characteristics, as opposed to a general category of products.

Last Month

Refers to the period of time immediately preceding the current month.

Q7: A technician spends 15 1/2 hours at

Q21: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the

Q69: One side of a triangle is twice

Q84: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the

Q163: Find the first four numbers of the

Q217: Use the property <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Use the

Q256: What number do you subtract from 5

Q267: Simplify both sides as much as possible,

Q297: Simplify the expression. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Simplify the

Q327: Work the following problem using the rule