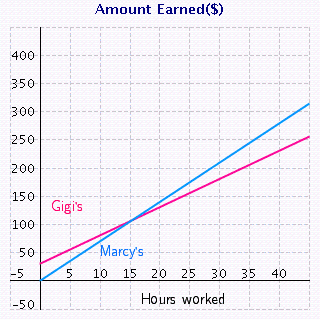

Jane is deciding between two sales positions. She can work for Marcy s and receive  per hour or for Gigi s, where she earns

per hour or for Gigi s, where she earns  per hour but also receives a $30 commission per week. The two lines in the following figure represent the money Jane will make for working at each of the jobs.

per hour but also receives a $30 commission per week. The two lines in the following figure represent the money Jane will make for working at each of the jobs.

. From the sketch of the graphed lines, how many hours would Jane have to work to earn the same amount at each of the positions?

. From the sketch of the graphed lines, how many hours would Jane have to work to earn the same amount at each of the positions?  . If Jane expects to work less than

. If Jane expects to work less than  hours a week, which job should she choose?

hours a week, which job should she choose?  . If Jane expects to work more than

. If Jane expects to work more than  hours a week, which job should she choose?

hours a week, which job should she choose?

Definitions:

Itemized Deductions

These are expenses allowed by the IRS that can be subtracted from adjusted gross income to reduce taxable income, emphasizing personal expenses.

Married Couple

A legal status for two individuals who are united in marriage, recognized by law, affecting tax and legal situations.

Itemizes

The process of listing tax-deductible expenses on a tax return individually, rather than taking the standard deduction.

Separate Returns

Tax returns filed by married individuals choosing not to file a joint tax return with their spouse, often detailing their own income, deductions, and liabilities.

Q5: Solve the system using the substitution method.

Q13: Two angles in a triangle are equal

Q17: Solve the system using the substitution method.

Q81: Factor the following number into the product

Q99: Factor by grouping. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Factor by

Q135: Multiply. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Multiply. A)

Q168: Divide the expression by <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Divide

Q188: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the

Q259: Perform the indicated operations. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Perform

Q260: Multiply. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Multiply. " class="answers-bank-image