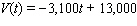

Straight-line depreciation is an accounting method used to help spread the cost of new equipment over a number of years. It takes into account both the cost when new and the salvage value, which is the value of the equipment at the time it gets replaced. The function  where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. What is the value of the copier after 1 years and 6 months?

where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. What is the value of the copier after 1 years and 6 months?  $__________

$__________

Definitions:

Discretionary Cost

Costs that are not essential for the operation of a home or business and can be adjusted or eliminated depending on financial circumstances.

Condensed Income Statement

A simplified financial statement that summarizes revenues, costs, and expenses to show a company's net income over a specific period.

Discontinuance

The action of stopping the production or sale of a product or service, often as a result of strategic business decisions.

Fixed Costs

Costs that tend to remain the same in amount, regardless of variations in the level of activity.

Q54: A boat on a river travels 50

Q104: Writing in 1829, former President James Madison

Q128: For the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="For the

Q134: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let Evaluate

Q146: Use the properties of exponents to simplify

Q154: Simplify the expression to a single fraction.

Q181: Solve the following system by the substitution

Q181: Solve the following proportion. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve

Q185: The maximum speed ( v ) that

Q239: Solve the system. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Solve the